Are you a Private Developer looking for your next project?

Are you a private developer looking for your next project? We have a pipeline of off-market opportunities within Greater London

Are you a private developer looking for your next project? We have a pipeline of off-market opportunities within Greater London

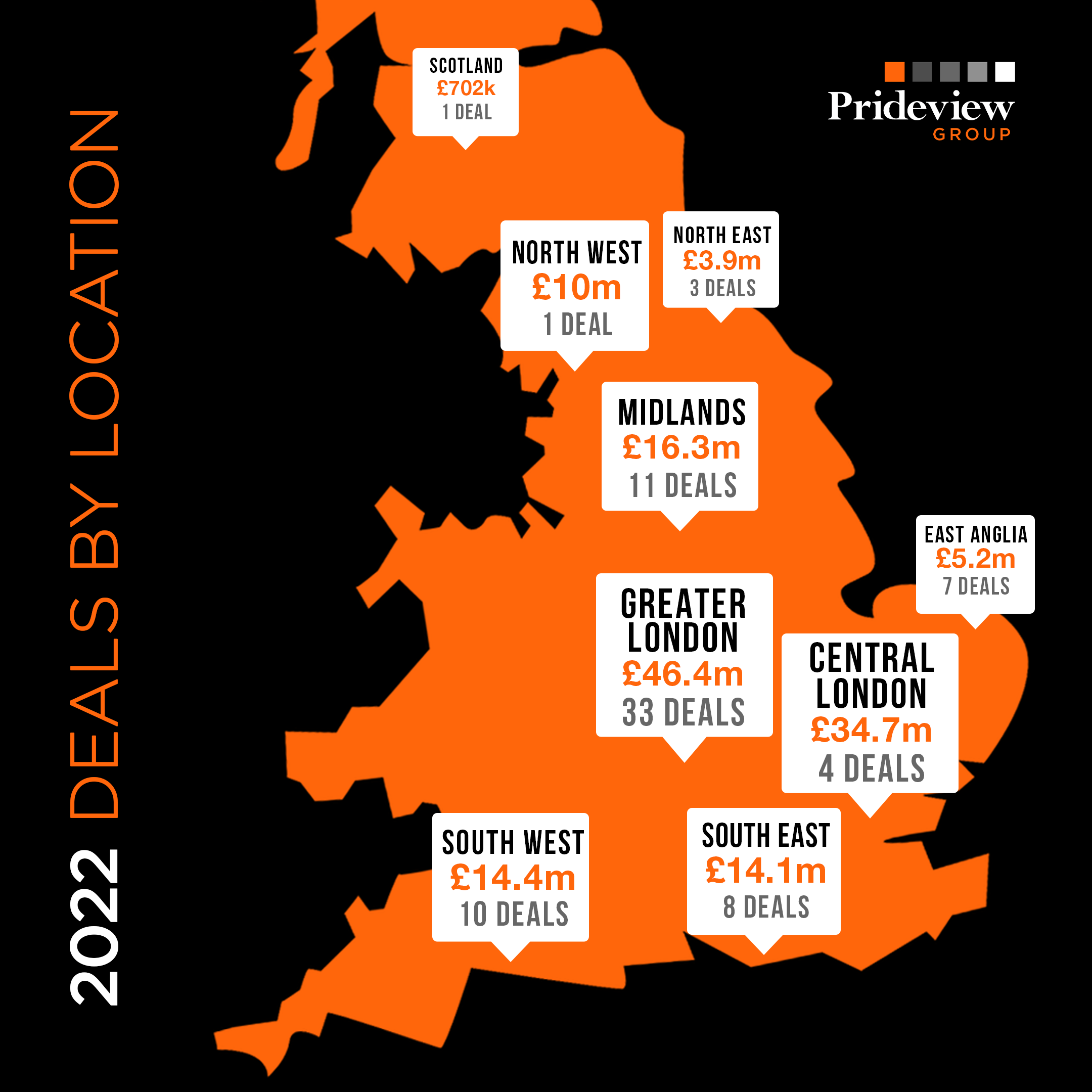

As we settle into a new year, we’re taking a look back at our 2023 deals and what we can

The Prideview Group will once again be in the South of France this year! To arrange a meeting please contact

Prideview Group has been at the forefront of commercial property investment services since 1985. For more than 35 years, we’ve been the premier choice for clients seeking expertise on the Acquisition, Management and Sale of quality commercial

We’ll come back to you straight away